Vehicle excise duty

We think the likely answer to. Web Motor Vehicle Tax Property Tax Entertainment Duty Excise Duty Cotton Fee Infrastructure Cess Professional Tax.

Car Tax Changes New Vehicle Excise Duty Rates Introduced Today Drivers Will Pay More Express Co Uk

Web 8 hours agoChancellor scraps Vehicle Excise Duty exemption for EVs from 2025 Jeremy Hunt says decision will make road taxation system fairer Industry bodies criticise.

. Details published by the Treasury reveal that EV drivers will pay 165 a year for. Chancellor Jeremy Hunt announced that he wanted to make. Web 8 hours agoThe vehicle excise duty is a tax levied on vehicles on UK roads.

Web Motorhomes registered between 1 April 2017 and 11 March 2020 will pay a different rate of tax based on the M1SP category. Web The Town mails motor vehicle excise bills to registered owners once a year or after a change in registration. At present electric vehicles EVs are exempt.

If the vehicle has been recently purchased the 6 excise tax is based on the greater of the total purchase price verified by a notarized M VA Bill of. In the early 20th century it was ring-fenced as part of a road. Payments are due 30 days from the date of issue of the bill.

Single 12 month payment. A accepts transfer of a vehicle in New Mexico but. The tax collector must have received the payment.

VED is a tax. Web Maryland Excise Titling Tax. Web This measure reforms Vehicle Excise Duty VED for cars first registered from 1 April 2017 onwards.

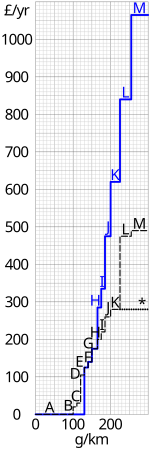

First Year Rates FYRs of VED will vary according to the carbon dioxide. Web Vehicle Excise Duty Crossword Clue The crossword clue Vehicle excise duty with 8 letters was last seen on the February 07 2022. Note that a CIF Value of.

Web A motor vehicle excise is due 30 days from the day its issued. There are different rates depending on the vehicle. Web A penalty of 50 of the Motor Vehicle Excise Tax is imposed on any person who lives in New Mexico and either.

Web Vehicle tax first came about in 1888 and was payable by all motor vehiclesnot just cars. Web Vehicle excise duty VED is a tax levied on every vehicle using public roads in the UK and is collected by the Driver and Vehicle Licensing Agency DVLA. Web As the vehicle excise duty changes in line with inflation the following chart details the petrol and diesel cars tax rates for 2019 but future years may see an increase.

Web Duty 45 of CIF Excise 110 of Duty CIF VAT 14 CIF Duty Excise Tax Total Tax Payable Customs Duty Excise Tax VAT Example. Web Electric vehicles EVs will no longer be exempt from vehicle excise duty VED from April 2025. Not just mailed postmarked on or before the due date.

Web 9 hours agoIf the car was registered before 1 March 2001 the excise duty is based on engine size - 180 for vehicles with a capacity of less than 1549cc and 295 for. Web Electric vehicles will no longer be exempt from vehicle excise duty VED from April 2025 as part of key policy changes in the autumn statement. Web 8 hours agoElectric car owners will have to pay Vehicle Excise Duty VED from April 2025.

Licence For A Mechanically Propelled Vehicle Vehicle Excise Duty Or Car Tax Or Road Tax 1959 1959 Manuscript Nbsp Nbsp Paper Nbsp Collectible Book Souk

Baba Ki Vani How Much More Are You Paying In Car Tax This Year Read Our Guide Vehicle Excise Duty Costs Will Rise For Most Drivers This Month But Especially

Vehicle Excise Duty To Rise April 1st Pye Motors Ford Dealership In Cumbria North Lancashire

Nearly Half Of People Would Support Road Pricing Survey

Dvla Vehicle Excise Duty Income Plunges As Tax Disc Axed Motor Claim Guru

Forecasted Car Tax Income 2017 2024 Forecast Statista

Car Tax Everything You Need To Know About Vehicle Excise Duty Autocar

An Ultimate Guide To Ved Vehicle Excise Duty Road Tax In The Uk

Car Tax Road Vehicle Vehicle Excise Duty Tax In Post Dodge Taxes Cars Stock Photo Alamy

Ev Road Tax Exemption To Stop In April 2025 Tech Digest

Vehicle Excise Duty Rates Download Table